Home – English

Welcome to the home of bebc real asset advisory

Please feel free to subscribe to our newsletter service straight here at our homepage. And don’t forget to check our blog to keep current …

Global Real Estate – Trends in the world’s largest asset class

Real Estate Asset Classes are safe harbor investments for institutional investors like insurance companies and pension funds, banks, asset managers, family offices and for people who like to create a sustainable passive dividend income stream. And everyone for whom F.I.R.E. is a word. That’s because of impressive and steady dividends on one hand and low volatility on the other. We are monitoring and charting those developments on a daily basis.

Please scroll down to find the table of indices we are monitoring

SHORTS May 14 2025: EU Industrial Index EXTENDED, currently 85 entries. Index Cap 2.764 tn EUR *, TOP 10 stock performers averaged YTD 2025 at 116%, YTD Jan 2024 at 210% (* tn = American, Index Cap = 2.764.000.000.000 EUR)

SHORTS May 01st 2025: EU Industrial Index created, Basis DAX Industrial, EURO only, currently 61 entries. Index Cap 556 bn EUR *, TOP 10 stock performers averaged YTD 2025 at 117%, YTD Jan 2024 at 199% (* bn = American, Index Cap = 556.000.000.000 EUR)

SHORTS Mar 02nd 2025: Multinational Aerospace Defence Index created, currently 42 entries. Index Cap 2.6 tn US$, TOP 10 stock performers averaged YTD 2025 at 63%, YTD Jan 2024 at 199%

SHORTS Jan 08th 2025: Index Table update, right here at our Homepage (please scroll down)

SHORTS Dec 17th 2024: eREIT ETF Index – Top 10 eREIT ETF Frw Dividend Yielders, Stock- and MC Performers as per Dec 11 2024

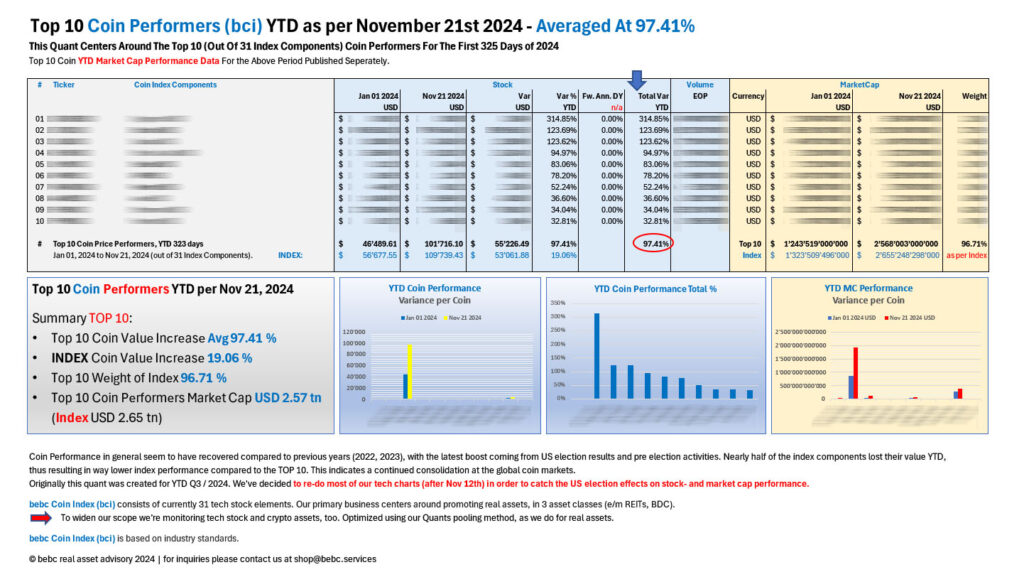

SHORTS Nov 24th 2024: bci (bebc coin index) – Top 10 Coin Price Coin- and MC Performers as per Nov 21 2024 (to cover US Election Effects)

SHORTS Nov 24th 2024: Nuclear Energy tech stock index – Top 10 Nuclear Energy Tech Stock Stock- and MC Performers as per Nov 12 2024 (to cover US Election Effects)

SHORTS Nov 17th 2024: bti (bebc tech stock index) – Top 10 bti TECH STOCK Frw Dividend Yielders, Stock- and MC Performers as per Nov 12 2024 (to cover US Election Effects)

SHORTS Nov 16th 2024: AI Tech Stocks – Top 10 AI TECH STOCK Frw Dividend Yielders, Stock- and MC Performers as per Nov 12 2024 (to cover US Election Effects)

SHORTS Oct 31st 2024: NUCLEAR TECH STOCK INDEX created. 20 stocks, Index YTD Stock Performance at 86.93%, Market Cap YTD up by 155%. Publishing will follow soon. Since power demand from AI is surging, those 20 power companies listed are – at least partially – involved in nuclear power business.

SHORTS Oct 24th 2024: US eREIT – Top 10 US Equity REIT Frw Dividend Yielders, Stock- and MC Performers as per Sep 30 2024

SHORTS Oct 18th 2024: EU eREIT – Top 10 EU Equity REIT Frw Dividend Yielders, Stock- and MC Performers as per Sep 30 2024

SHORTS Oct 18th 2024: US mREIT – Top 10 US Mortgage REIT Frw Dividend Yielders, Stock- and MC Performers as per Sep 30 2024

SHORTS Jan 09th 2024: Index Table update, right here at our Homepage (please scroll down)

SHORTS: Article: Why invest in US equities now?

SHORTS: Article: REITs vs. REIT ETFs on How They Compare

SHORTS: Article: U.S. Securities and Exchange Commission on What are REITs?

Here are the indices currently monitored:

| Asset Class | Geo / Market | # Stocks (as of Jan 2025) |

Market Cap Jan 02, 2023 USD |

Market Cap Jan 02, 2024 USD | Market Cap Jan 02, 2025 USD | Diff. 2024/25 USD |

| mREIT | USA | 37 | 54.4 bn | 58.7 bn | 58.7 bn | 4.3 bn |

| eREIT | USA | 151 | 1.409 tn | 1.548 tn | 1.548 tn | 139 bn |

| eREIT | EU | 86 | 235.1 bn | 270.7 bn | 270.7 bn | 35.6 bn |

| eREIT | Canada | 33 | 52.2 bn | 49.4 bn | 49.4 bn | – 2.8 bn |

| eREIT | Australia | 38 | 104.2 bn | 109.1 bn | 109.1 bn | 4.9 bn |

| eREIT | Taiwan | 7 | 3.9 bn | 3.7 bn | 3.7 bn | – 200 mn |

| eREIT | S Korea | 7 | 1.89 bn | 1.76 bn | 1.76 bn | – 130 mn |

| eREIT | Hong Kong | 11 | 43.8 bn | 37.9 bn | 37.9 bn | – 5.9 bn |

| eREIT ETF | USA | 29 | 65.2 bn | 61.2 bn | 61.2 bn | – 4.0 bn |

| eREIT ETF | Canada | 7 | 5.47 bn | 5.96 bn | 5.96 bn | 490 mn |

| mREIT ETF | USA | 3 | 921 mn | 913 mn |

913 mn |

– 8 mn |

| AI Tech ETF | USA, EU, GB | 27 | 40.35 bn |

46.83 bn |

6.48 bn | |

| BDC | USA | 41 | 51.2 bn | 54.7 bn | 54.7 bn | 3.5 bn |

| AI tech index | USA | 40 | 8.99 tn | 14.94 tn | 21.04 tn | 6.1 tn |

| Nuclear Pwr tech index | USA | 20 | 396.0 bn | 415.1 bn | 588.8 bn | 173.7 bn |

| bti (bebc tech index) | USA | 367 | 18.3 tn | 28.5 tn | 28.5 tn | 10.2 tn |

| bci (bebc crypto index) | global | 31 | 601.9 bn | 1.32 tn | 1.32 tn | 720 bn |

Index Overview as of Jan 2025

Our Shop is carefully segmented to understand and to help navigating btwn. different asset classes und global regions (geographically). Please feel free to subscribe to our newsletter service right here at our homepage.

HBSC Study: Real estate is a very large asset class by value. The yearly HBSC report (linked below) examines this value as a global asset class. It shows how local property markets are becoming part of a global phenomenon experienced by many investors (private and institutional) around the world.

Comments