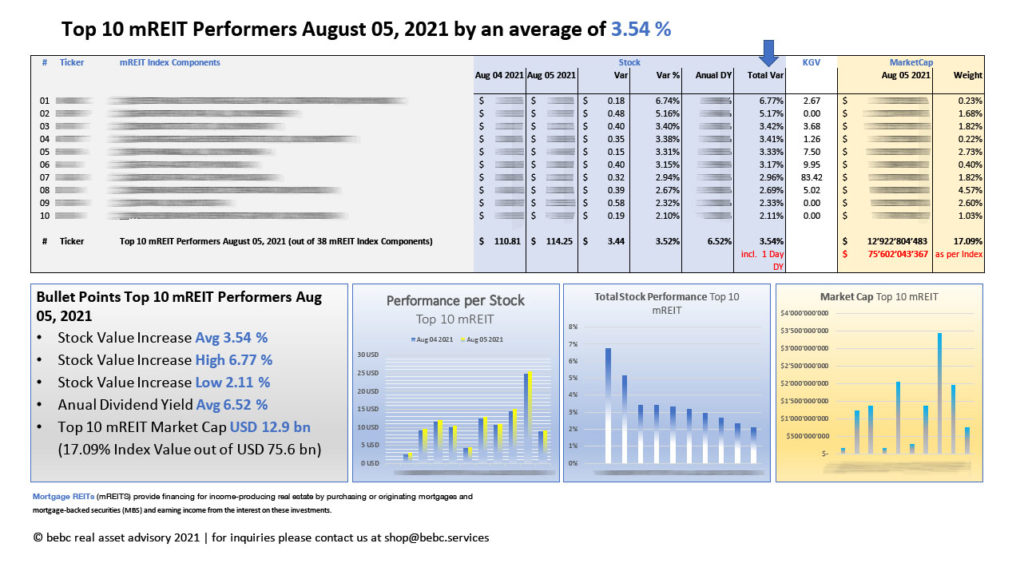

- Top 10 US mREIT Performers August 05, 2021 by an average of 3.54 %

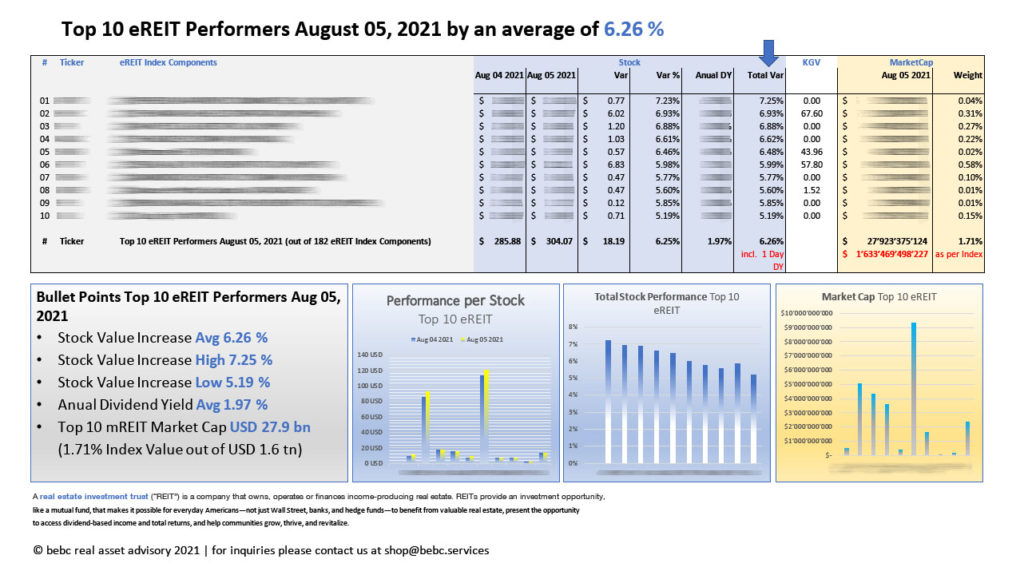

- Top 10 US eREIT Performers August 05, 2021 by an average of 6.26 %

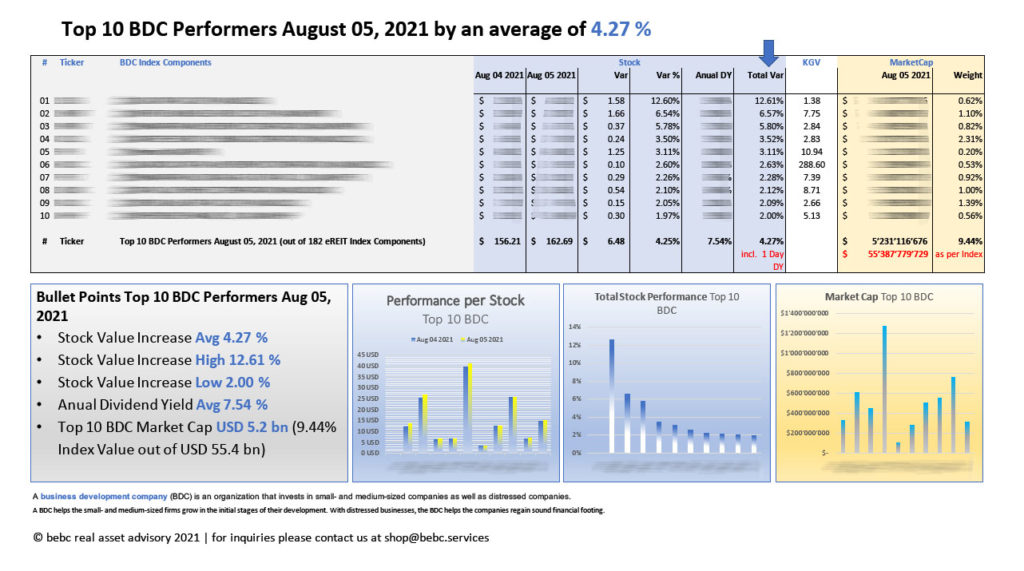

- Top 10 US BDC Performers August 05, 2021 by an average of 4.27 %

https://bebc.services/produkt-kategorie/assets/singleday/

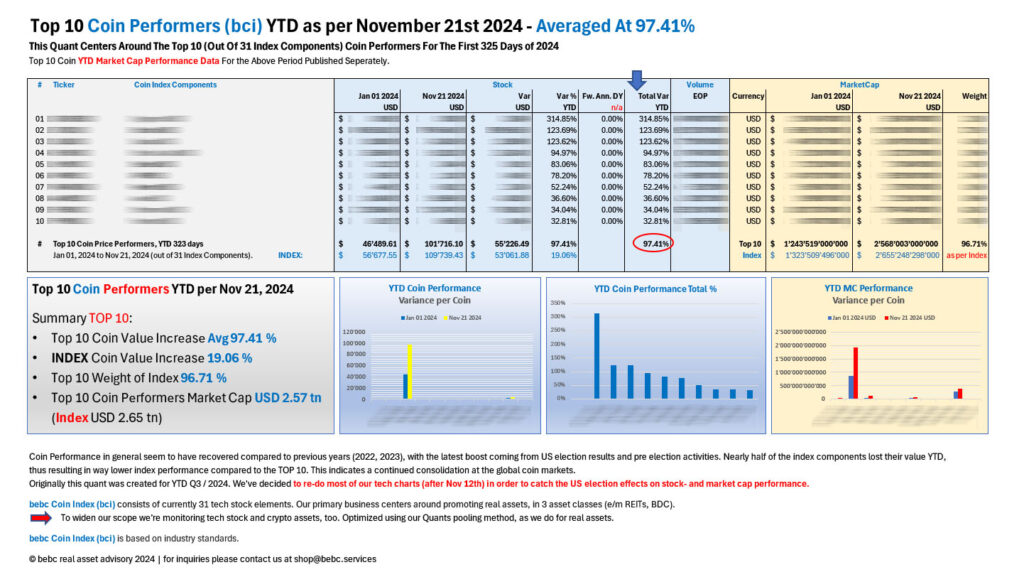

US mREITs, eREITs and BDCs are part of high performing, non volatile Asset Class and as such to be classified as Asset Backet Securities. Real Assets are the way to go (or to invest) for long term growth and performance. Especially if the investor maintains a buy-and-hold mindset, targeted to long term stable investments … and to high dividend yields.

Real Estate Asset Classes are a safe harbor investment for institutional investors like insurance companies and pension funds, banks, asset managers, family offices and for people who like to create a sustainable passive dividend income stream. And everyone for whom F.I.R.E. is a word. That’s because of impressive and steady dividends on one hand and low volatility on the other. We are monitoring and charting those developments on a daily basis. We are selling those charts and we are providing consulting based on our monitoring results. Helping investors to achieve a better performing asset landscapes.