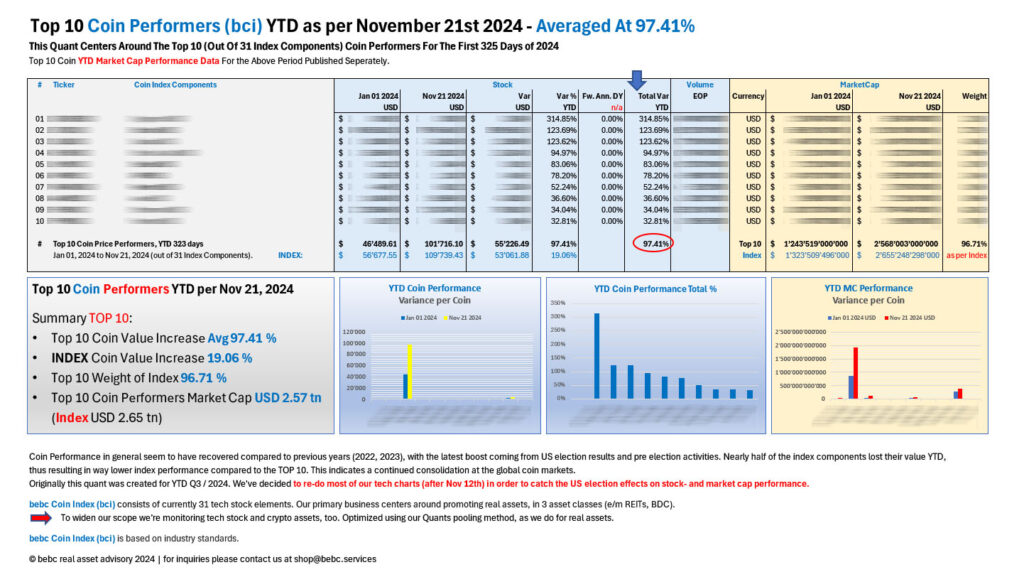

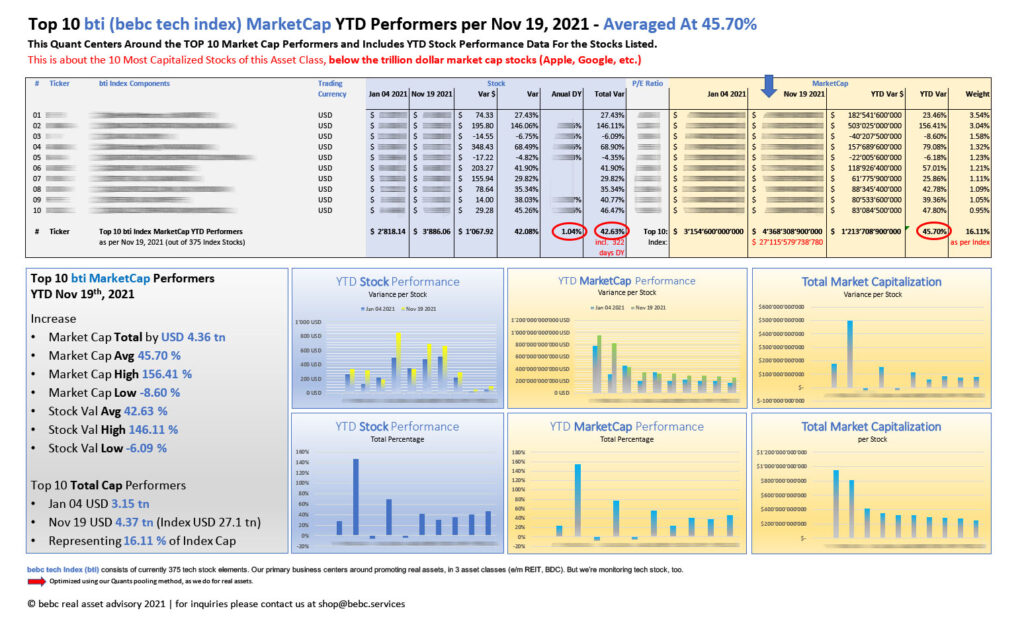

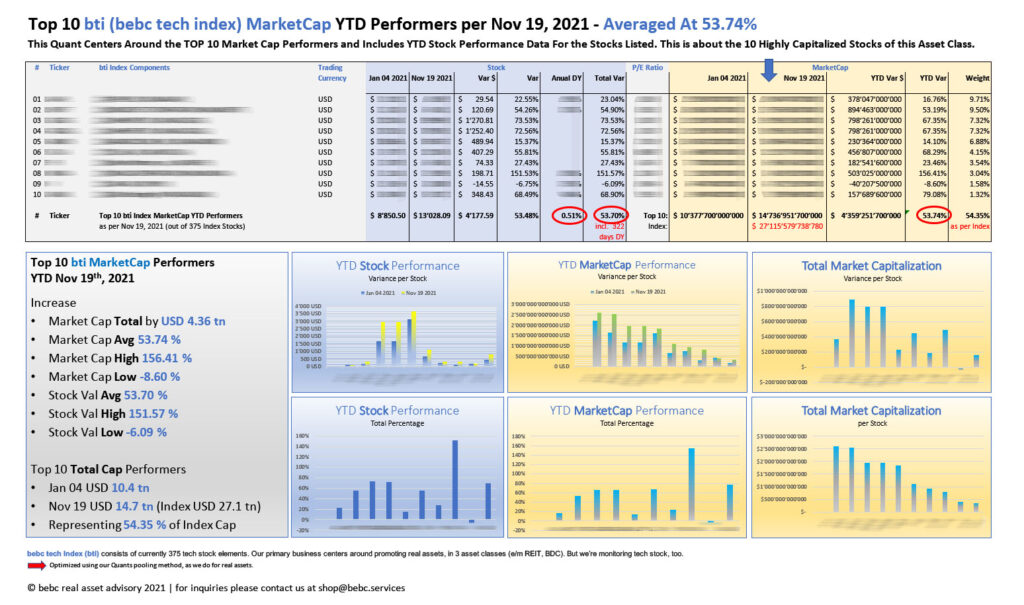

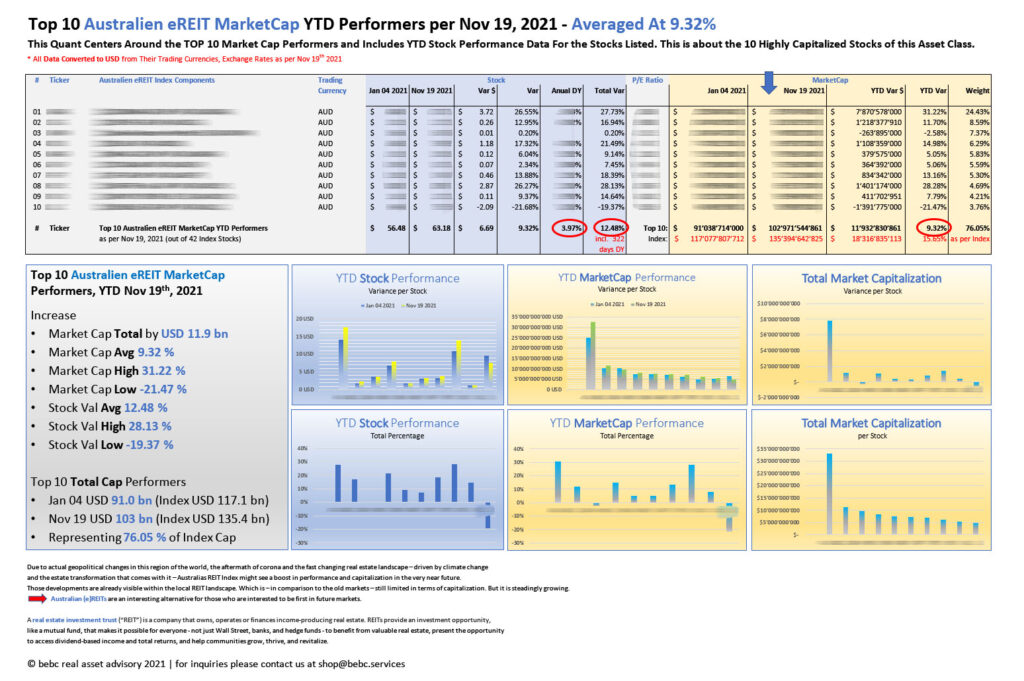

Our Newsletter emphasized the fact, that the shop is carefully segmented for faster information access. One of the major KPIs in real estate asset classes is Market Capitalization. Thus we’ve created a new shop section dealing especially with capitalization analyses in the form of our TOP 10 Quant analyses.

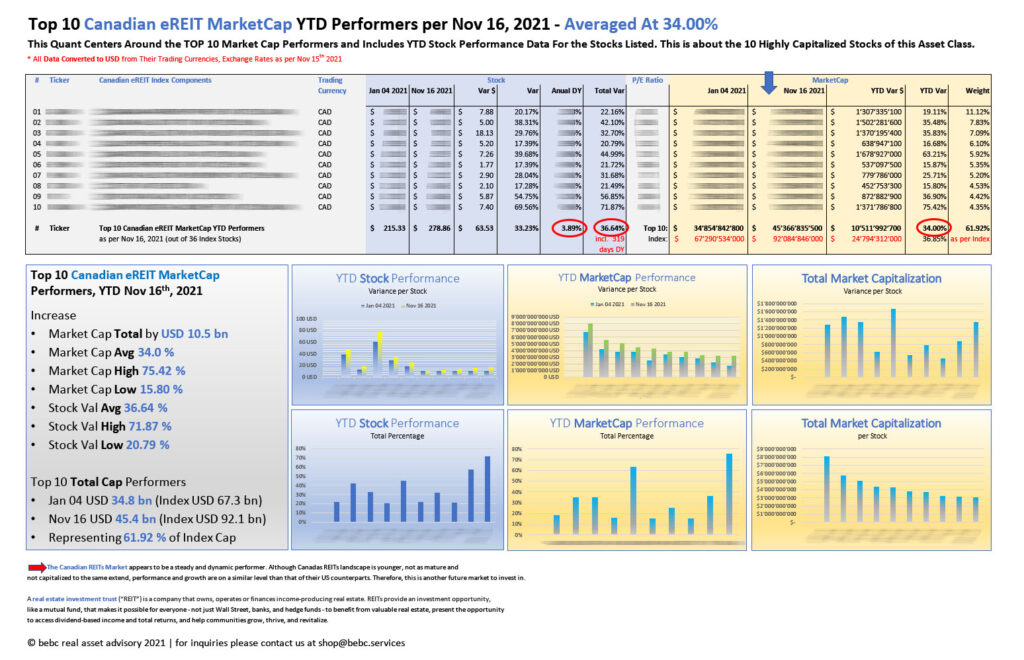

Quants in this shop section show TOP 10 Stock Caps at the end of a certain period (mostly YTD), together with stock performance for that period. Those are the highest capitalized stocks in their asset segment.

Our latest additions to this section are dealing with YTD Australien , Canadian and tech index cap data.

A real estate investment trust (“REIT”) is a company that owns, operates or finances income-producing real estate. REITs provide an investment opportunity, like a mutual fund, that makes it possible for everyone — not just Wall Street, banks, and hedge funds — to benefit from valuable real estate, present the opportunity to access dividend-based income and total returns, and help communities grow, thrive, and revitalize.

bebc tech Index (bti) currently consists of 375 tech stock elements. Our primary business centers around promoting real assets, in 3 asset classes (e/m REIT, BDC). But we’re monitoring tech stock, too. Optimized using our Quants pooling method, as we do for real assets.

Please feel free to subscribe to our newsletter service at our homepage.