Description

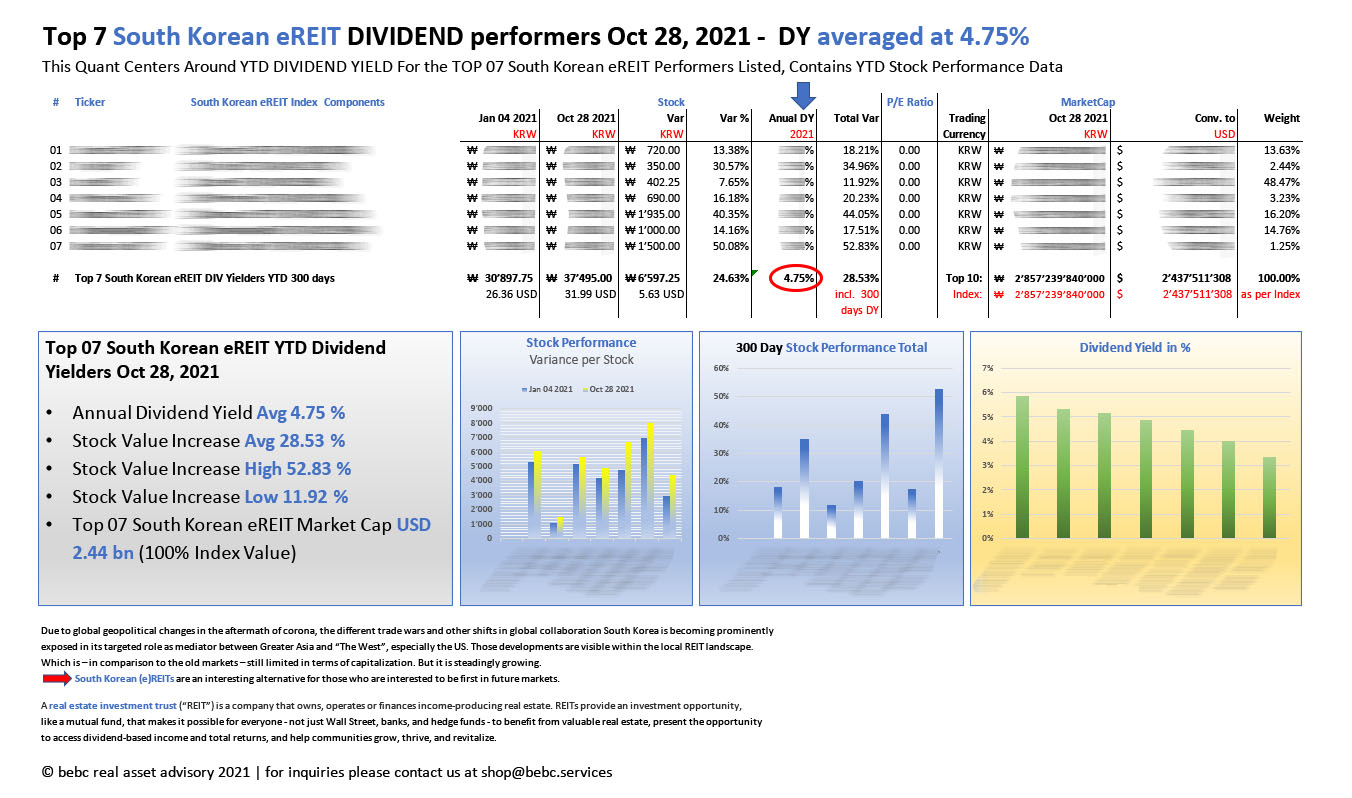

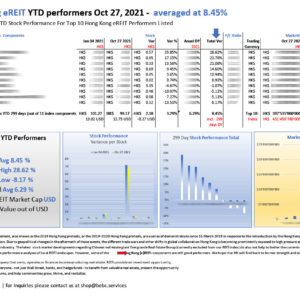

Top 07 South Korean eREIT DIVIDEND performers Oct 28 2021 (300 Days): averaged at 4.75%

Due to global geopolitical changes in the aftermath of corona, the different trade wars and other shifts in global collaboration South Korea is becoming prominently exposed in its targeted role as mediator between Greater Asia and “The West”, especially the US. Those developments are visible within the local REIT landscape. Which is – in comparison to the old markets – still limited in terms of capitalization. But it is steadingly growing. South Korean (e)REITs are an interesting alternative for those who are interested to be first in future markets.

A real estate investment trust (“REIT”) is a company that owns, operates or finances income-producing real estate. REITs provide an investment opportunity, like a mutual fund, that makes it possible for everyone — not just Wall Street, banks, and hedge funds — to benefit from valuable real estate, present the opportunity to access dividend-based income and total returns, and help communities grow, thrive, and revitalize.

Please feel free to subscribe to our newsletter service at our homepage.

Reviews

There are no reviews yet.