Description

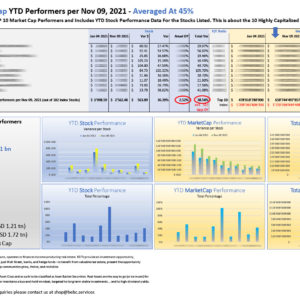

Top 10 Canadian eREIT DIVIDEND performers Oct 13, 2021: averaged at 7.12%

Index Dividend Performance YTD Oct 2021, all 36 components: averaged at 4.59%

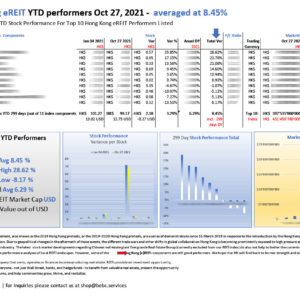

The Canadian REITs Market appears to be a steady and dynamic performer. Although Canadas REITs landscape is younger, not as mature and not capitalized to the same extend, performance and growth are on a similar level than that of their US counterparts. Therefore, this is another future market to invest in. Especially if the investor maintains a buy-and-hold mindset, targeted to long term stable investments … and to high dividend yields.

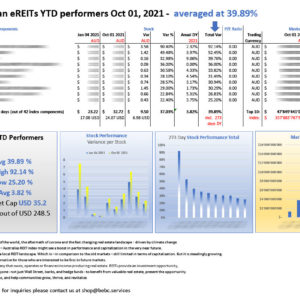

A real estate investment trust (“REIT”) is a company that owns, operates or finances income-producing real estate. REITs provide an investment opportunity, like a mutual fund, that makes it possible for everyday Americans—not just Wall Street, banks, and hedge funds—to benefit from valuable real estate, present the opportunity to access dividend-based income and total returns, and help communities grow, thrive, and revitalize.

Please feel free to subscribe to our newsletter service at our homepage.

Reviews

There are no reviews yet.