Description

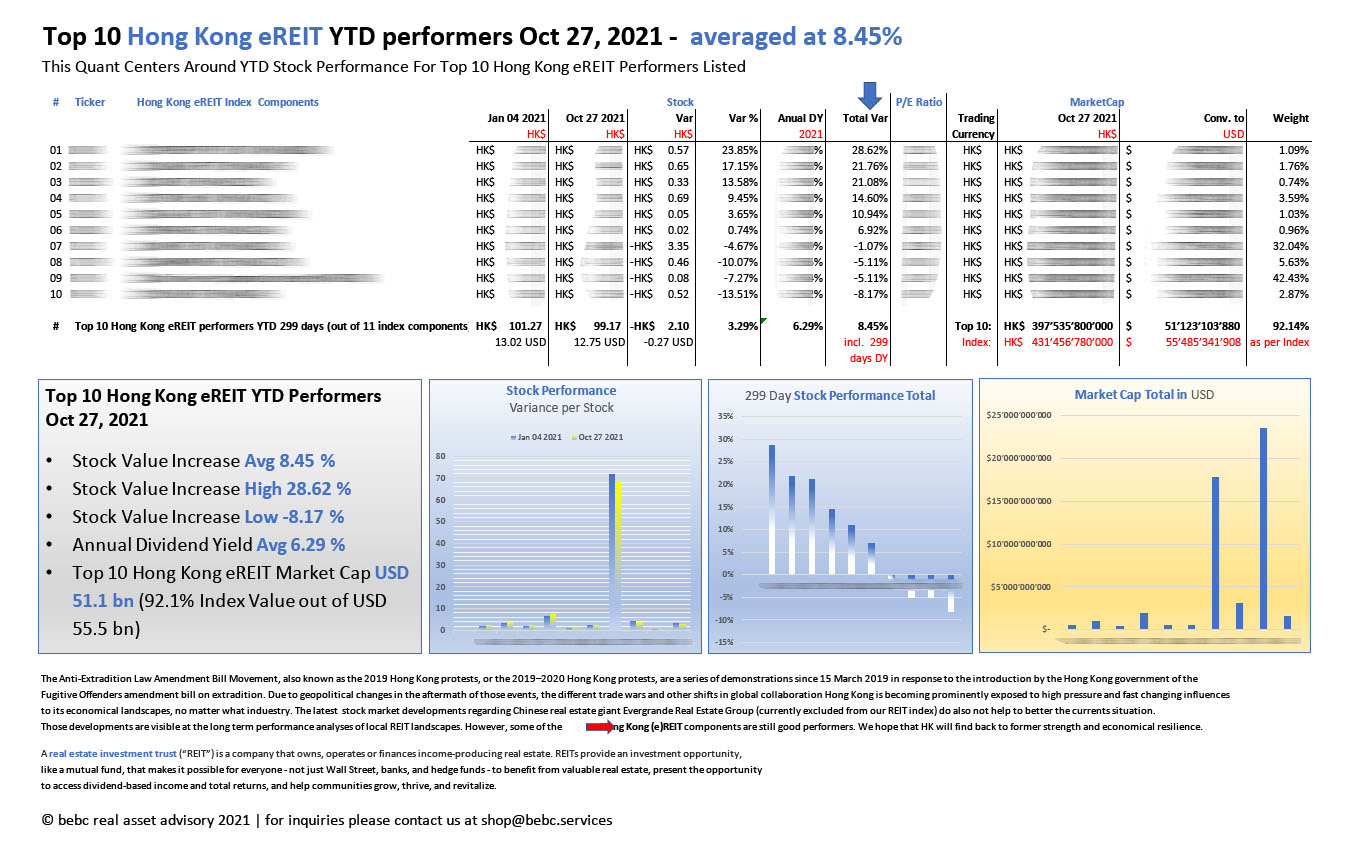

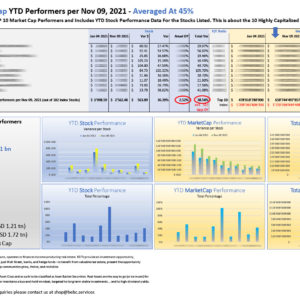

Top 10 Hong Kong eREIT YTD Performers Oct 27, 2021 (299 Days): averaged at 8.45%

The Anti-Extradition Law Amendment Bill Movement, also known as the 2019 Hong Kong protests, or the 2019–2020 Hong Kong protests, are a series of demonstrations since 15 March 2019 in response to the introduction by the Hong Kong government of the Fugitive Offenders amendment bill on extradition. Due to geopolitical changes in the aftermath of those events, the different trade wars and other shifts in global collaboration Hong Kong is becoming prominently exposed to high pressure and fast changing influences to its economical landscapes, no matter what induestry. The latest stock market developments regarding Chinese real estate giant Evergrande Real Estate Group (currently excluded from our REITs index) do also not help to better the currents situation. Those developments are visible at the long term performance analyses of local REIT landscapes. However, some of the Hong Kong (e)REIT components are still good performers. We hope that HK will find back to former strength and economical resilience.

A real estate investment trust (“REIT”) is a company that owns, operates or finances income-producing real estate. REITs provide an investment opportunity, like a mutual fund, that makes it possible for everyone — not just Wall Street, banks, and hedge funds — to benefit from valuable real estate, present the opportunity to access dividend-based income and total returns, and help communities grow, thrive, and revitalize.

Please feel free to subscribe to our newsletter service at our homepage.

Reviews

There are no reviews yet.