Description

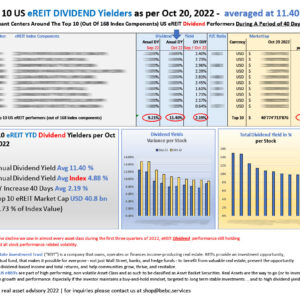

Top 10 US eREITs DIVIDEND performers Aug 31, 2022: averaged at 9.38%

Index Dividend Performance Aug 2022, all 179 components: averaged at 4.44%

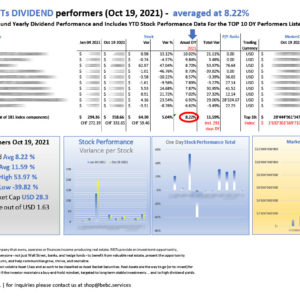

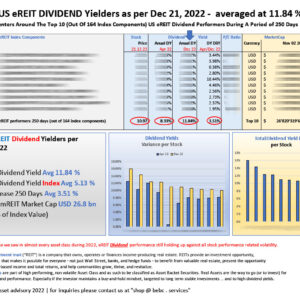

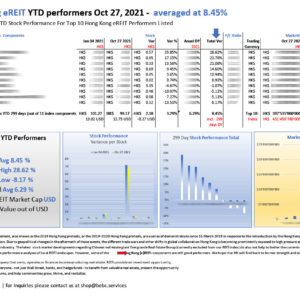

Despite the decline we saw in almost every asset class during the first two quarters of 2022, eREIT Dividend performance still holding up against all stock performance related volatility.

US eREITs are part of high performing, non volatile Asset Class and as such to be classified as Asset Backet Securities. Real Assets are the way to go (or to invest) for long term growth and performance. Especially if the investor maintains a buy-and-hold mindset, targeted to long term stable investments … and to high dividend yields.

A real estate investment trust (“REIT”) is a company that owns, operates or finances income-producing real estate. REITs provide an investment opportunity, like a mutual fund, that makes it possible for everyone — not just Wall Street, banks, and hedge funds — to benefit from valuable real estate, present the opportunity to access dividend-based income and total returns, and help communities grow, thrive, and revitalize.

Please feel free to subscribe to our newsletter service at our homepage.

Reviews

There are no reviews yet.