Description

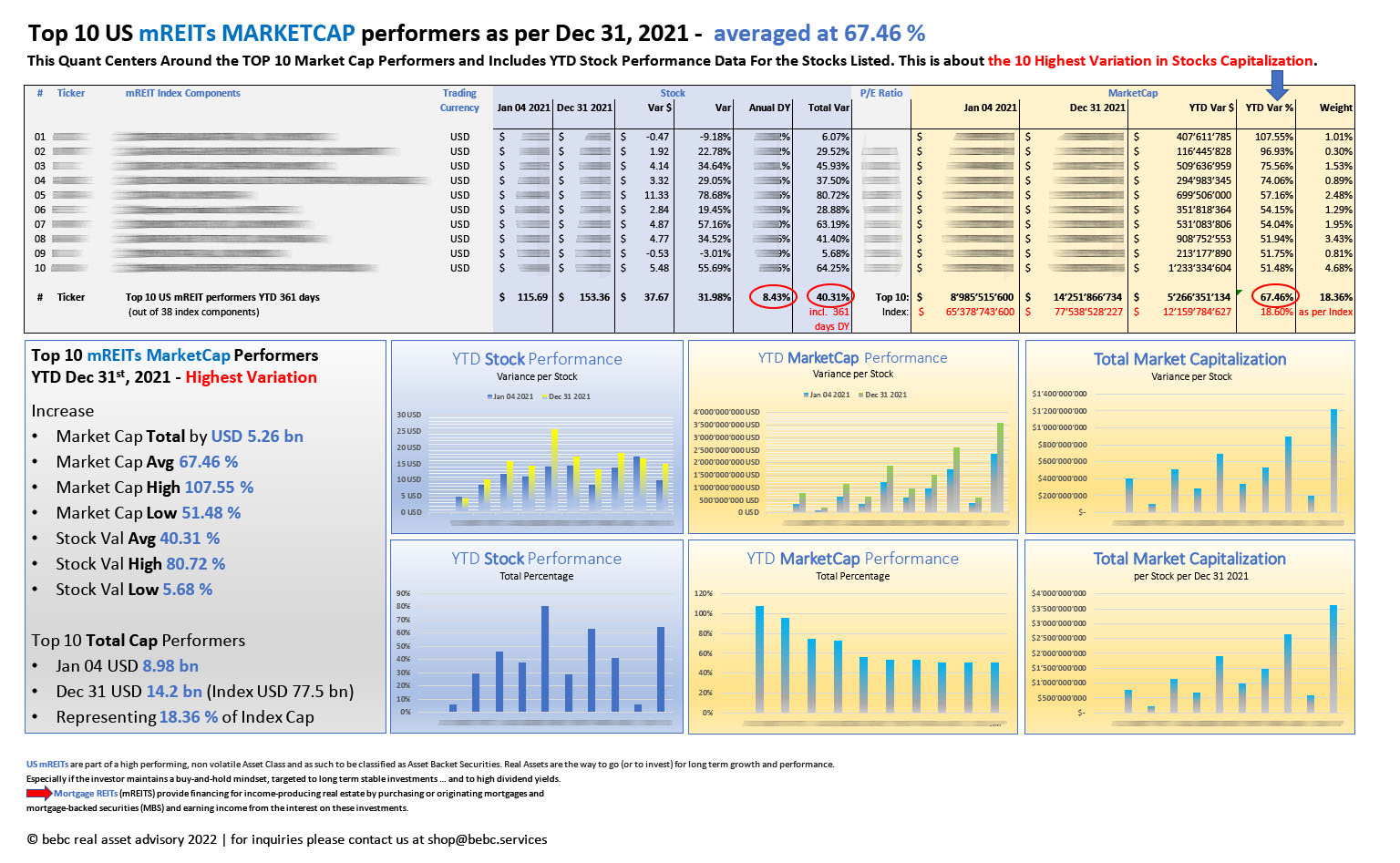

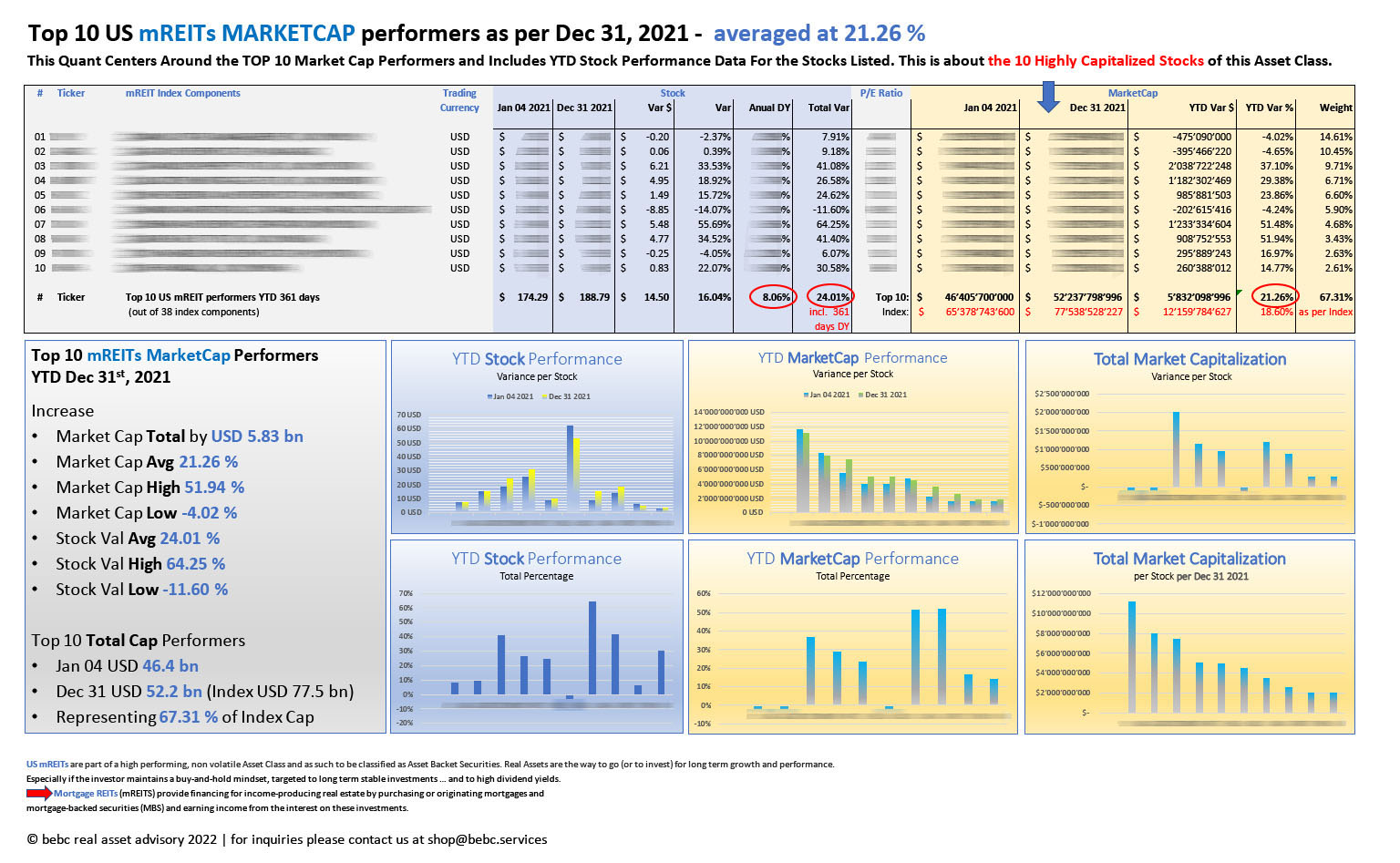

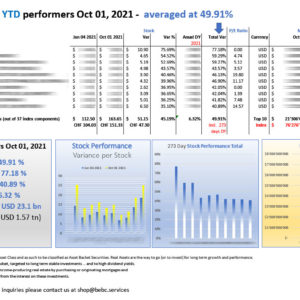

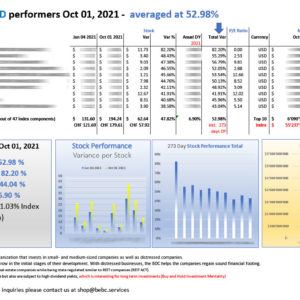

Top 10 US mREIT MARKETCAP YTD Performers Dec 31, 2021. This product features 2 quants:

- Top 10 Highly Capitalized Stocks of this Asset Class, averaged at 21.26%

- Top 10 Highest Variation in Stocks Capitalization, averaged at 67.46%

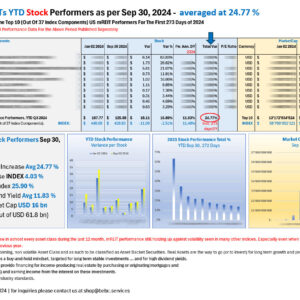

Index MarketCap Performance YTD Dec 31 2021, all 38 components: averaged at 24.73%

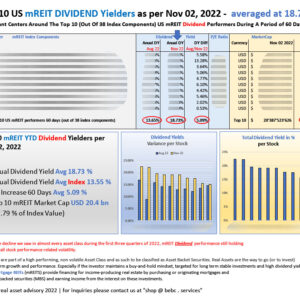

US mREITs are part of high performing, non volatile Asset Class and as such to be classified as Asset Backet Securities. Real Assets are the way to go (or to invest) for long term growth and performance. Especially if the investor maintains a buy-and-hold mindset, targeted to long term stable investments … and to high dividend yields.

Mortgage REITs (mREITS) provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities (MBS) and earning income from the interest on these investments.

Please feel free to subscribe to our newsletter service at our homepage.

Reviews

There are no reviews yet.