Description

Top 10 US REIT ETF DIVIDEND Yielders Nov 03, 2021: averaged at 3.89%

Index Dividend Performance YTD Nov 03 2021, all 29 components: averaged at 2.56%

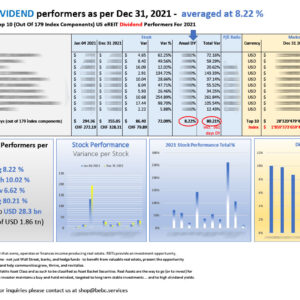

REIT exchange-traded funds (ETFs) invest their assets primarily in equity REIT securities and other derivatives (Source: Investopedia). These REIT indexes include a number of different types of REITs as components. By tracking an index – or in case of our bebc ETF index a number of different indexes – an investor can gain exposure to a much larger real estate sector without risking investments on one individual company. Means, investments are widely spread and enable for a much higher amount of risk mitigation.

The bebc REIT ETF index currently represents 29 US ETFs, every fund invested in multiple REIT assets.

A real estate investment trust (“REIT”) is a company that owns, operates or finances income-producing real estate. REITs provide an investment opportunity, like a mutual fund, that makes it possible for everyone — not just Wall Street, banks, and hedge funds — to benefit from valuable real estate, present the opportunity to access dividend-based income and total returns, and help communities grow, thrive, and revitalize.

Please feel free to subscribe to our newsletter service at our homepage.

Reviews

There are no reviews yet.