Description

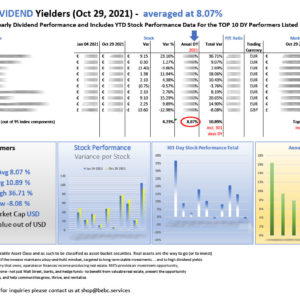

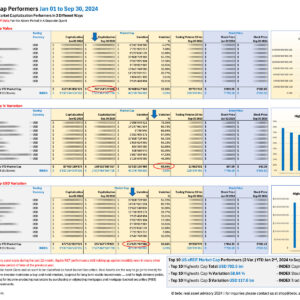

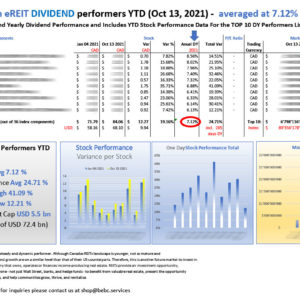

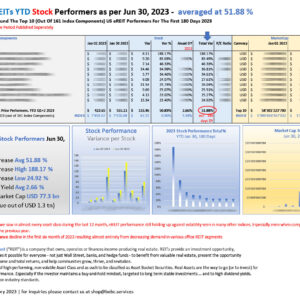

Top 10 US eREITs DIVIDEND Yields 250 days April to December 21, 2022: averaged at 11.84%

Change over 250 days averaged at 3.51%

Index Dividend Yields YTD Oct 2022, all 168 components: averaged at 5.13%

Despite the decline we saw in almost every asset class during 2022, eREIT dividend yields still holding up against all stock performance related volatility.

US eREITs are part of high performing, non volatile Asset Class and as such to be classified as Asset Backet Securities. Real Assets are the way to go (or to invest) for long term growth and performance. Especially if the investor maintains a buy-and-hold mindset, targeted to long term stable investments … and to high dividend yields.

A real estate investment trust (“REIT”) is a company that owns, operates or finances income-producing real estate. REITs provide an investment opportunity, like a mutual fund, that makes it possible for everyone — not just Wall Street, banks, and hedge funds — to benefit from valuable real estate, present the opportunity to access dividend-based income and total returns, and help communities grow, thrive, and revitalize.

Please feel free to subscribe to the newsletter service at our homepage.

Reviews

There are no reviews yet.