Description

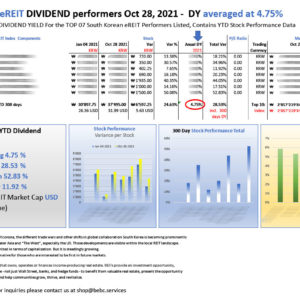

Top 10 European eREIT DIVIDEND performers Oct 29, 2021: averaged at 8.07%

Index Dividend Performance YTD Oct 29 2021, all 95 components: averaged at 3.30%

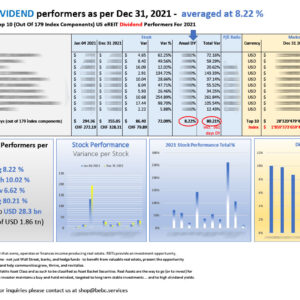

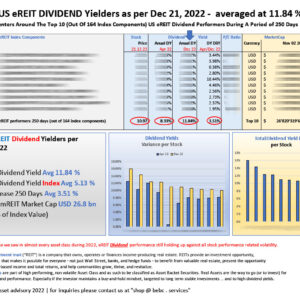

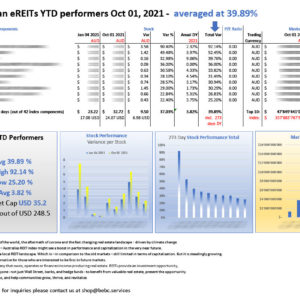

EU eREITs are part of high performing, non volatile Asset Class and as such to be classified as asset-backet securities. Real assets are the way to go (or to invest) for long term growth and performance. Especially if the investor maintains a buy-and-hold mindset, targeted to long term stable investments … and to high dividend yields.

A real estate investment trust (“REIT”) is a company that owns, operates or finances income-producing real estate. REITs provide an investment opportunity, like a mutual fund, that makes it possible for everyone — not just Wall Street, banks, and hedge funds — to benefit from valuable real estate, present the opportunity to access dividend-based income and total returns, and help communities grow, thrive, and revitalize.

Please feel free to subscribe to our newsletter service at our homepage.

Reviews

There are no reviews yet.